Quarterly Energy Review

ERCE Energy Review Q2 2022

Providing numerical insights and commentary on the oil & gas sector and the wider energy industry.

Welcome to the Q2 2022 edition of the ERCE Energy Review, a quarterly that provides numerical insights and commentary on the oil and gas sector and the wider energy industry, is now available.

This issue covers:

- Outlook on the energy industry

- Oil & Natural Gas Trading Prices

- Brent Future Oil and UK NBP Gas Price Decks

- Oil & Gas Market Activity & Fundamentals

- Energy Transition and EUA Forecasts

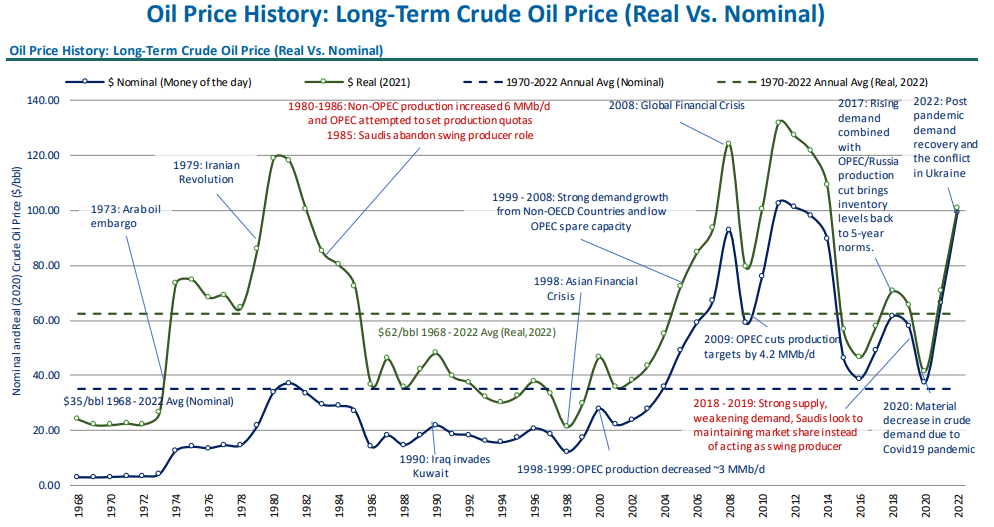

Status Quo: Brent prices touched a 14-year high of US$139.13/bbl on 7th March, on the escalation of the conflict in Ukraine and the subsequent decision by the US, Canada, and the UK to halt oil imports from Russia, the world’s third largest oil exporter. By the middle of March, Brent prices had moderated back to US$100/bbl on optimism of cease-fire talks between Russia and Ukraine and the implementation of COVID lockdowns in China but settled near US$110/bbl at the end of the month. European gas prices had hit record highs due to the uncertainties relating to Russian gas supply, which accounts for almost 40% of the European Union’s supply.

Short-term: Short-term consensus on oil prices is dependent on the balance between the Russia supply loss, OPEC supply response and global demand. In its April meeting, OPEC+ had decided to stick close to its previously decided production increase by hiking output by 432,000 bpd in May, ignoring calls from the Biden administration for a greater hike in output. In response, the Biden administration announced a release of 1 MMbbl/d of oil from the Strategic Petroleum Reserve for 6 months in a bid to lower gasoline prices. US officials are also exploring alternatives to Russian oil and lifting sanctions on Iran and Venezuela. The US EIA has forecasted that US crude oil production will rise to a record-high production of 13 MMbbl/d in 2023 as producers increase drilling activities in response to the high oil prices. The EIA forecasts that Brent prices will average US$102/bbl in the second half of 2022, then fall to US$89/bbl in 2023.

Medium-term: The repercussions of the current conflict in Ukraine will impact the medium-term outlook. According to Bloomberg, the exit of oil services firms like Halliburton, Schlumberger, and Baker Hughes may slow the growth of Russian production within the next 10 years due to the lack of expertise in developing more technically challenging reserves, like viscous crude and shale. According to the IMF, a drawn out conflict may lead to global inflation, disrupted trade and supply chains, a reduced business confidence, and higher investor uncertainty. The slowdown of the global economy may affect consumption and impact long term oil and gas demand.

Long-term: In its Energy Outlook 2022, BP had projected that oil demand will rise above pre-pandemic levels in 2025 for all three forecasted scenarios. In the most bullish scenario for oil, demand peaks in 2030 then falls due to the declining use of oil in road transportation. It forecasts that US tight oil production will recover till 2030, but will begin to fall and lose market share to OPEC in the years after. The European Union’s recently published REPowerEU framework aims to diversify fossil fuel supply and raises the target for renewables’ share of the primary energy supply in 2030 to 45% from 40%.